QANTAS – QANAU 2.95 27/11/2029

Qantas is the world’s second oldest airline. Founded in the Queensland outback in 1920 it provided an air link between Charleville and Cloncurry in Queensland. After growing regionally, by 1930 it covered Northeastern Australia with many more air routes. Qantas moved its headquarters to Sydney in 1938. Qantas International is the largest carrier into and out of Australia, also targeting business and premium leisure customers who value the full-service experience. It also operates Jetstar as a low-cost option through Australia and south-east Asia. Qantas operates through four segments: Qantas Domestic (about 35% of revenue); Qantas International (more than 35% of revenue); Jetstar Group (nearly 10%); and Qantas Loyalty (some 15%).

The years of COVID lockdowns were tough for all airlines and the negative operating environment persisted into mid-2022. The turnaround since then has been very significant and has been accompanied by sound efforts at cost reduction and other measures such as dividends being stopped while the recovery continues. Despite the recent softness in its share price its market capitalisation is AUD 9.3b, some 10% higher than the lows of 2022. Accompanying this, the group surged back to a record $2.4b profit in FY23, with revenues more than doubling. With the launch of its Climate Action Plan in March 2022, the company has more formally integrated ESG considerations into its fleet planning. As part of its plan to reduce net emissions by 25% by 2030 and to net zero by 2050.

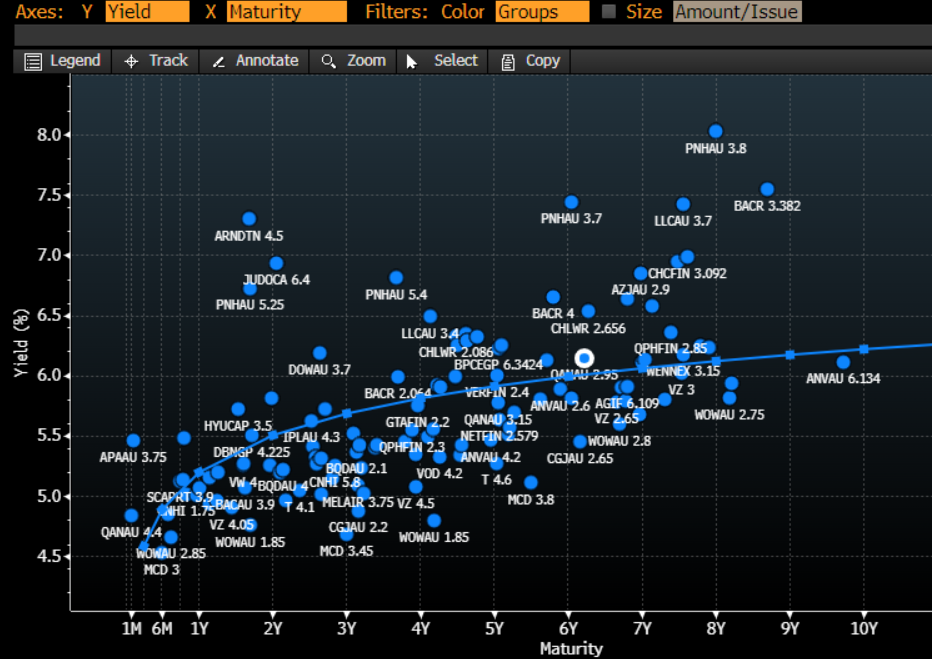

The senior unsecured bond issued by Qantas has a coupon of 2.95% and a November 2029 final maturity date. We believe the bond represents attractive risk adjusted returns due to the following reasons:

- Qantas retains as a priority the reduction net debt and a significant free float of cash and is in a strong position in terms of undrawn debt facilities.

- Qantas has a prudent capital management policy and in the sweet spot with favourable “tailwinds” for the sector post COVID lockdowns.

- The large movement in bond yields since mid-2022 means it has allowed investors to invest at a significant discount to par. Currently, the clean price was last marked at 84, implying a yield to maturity around 6%.

These senior unsecured bonds are investment grade rated. We have high conviction in the ability of the issuer to maintain an investment-grade rating and not fall to sub-investment grade. In terms of comparable bonds in this sector, Qantas’ senior unsecured bond looks to be attractively priced compared to the rating sector and pays a significant discount given the following risks factored in.

Key Risks:

- A global pandemic which provides a negative operating environment to what persisted into mid-2022

- Inability to integrate ESG considerations into its fleet planning

- A change in conservative management of its balance sheet

Relative Value (against rating sector)