GPT – GPTAU 2.85 20/02/2032

The General Property Trust was launched as Australia’s first ever property trust when it was listed on the Australian Securities Exchange (ASX) in 1971. The trust was launched and initially managed by Lendlease who wanted to provide retail investors the opportunity to invest in a portfolio of high-quality commercial property assets, and in 2005, a proposal was put to shareholders which resulted in GPT separating from Lendlease to become an independent company.

Today GPT manages a portfolio that is valued at more than $20 billion and includes retail, office, logistics, and business park assets.[5] This focus is accompanied by Funds Management and selective development. In February 2021, the company signed an $800 million 50:50 joint venture with an industrial-focused Canadian fund manager, QuadReal Property Group.[6] GPT is ranked as one of the foremost global performing property and real estate companies in international sustainability benchmarks and awards. It has held the number one or two position for the last nine years on the Dow Sustainability Index.

The retail portfolio performed strongly in the period, with high occupancy maintained and strong leasing outcomes achieved. Retail sales across the portfolio were above the prior comparable period and our CBD located asset at Melbourne Central is back to pre-pandemic retail sales levels. Leasing spreads continued to strengthen, with lease structures consisting of fixed base rents and annual fixed increases. Office occupancy remained something of a challenge post-COVID and was static at 88.5%.

The senior unsecured bond issued by GPT has a coupon of 2.85% and a February 2032 final maturity date. We believe the bond represents attractive risk adjusted returns due to the following reasons:

- GPT’s gearing on 30 June 2023 was 28.1% and remains below the mid-point of their stated range of 25 – 35%. Furthermore, GPT maintains undrawn credit lines of $1.6 billion which provides adequate liquidity if needed.

- GPT’s funds from operations (FFO) across being the retail and logistics businesses is amongst the highest in the Australian Real Estate Investment (AREIT) sector and provides a buffer against any asset write-downs.

- The bonds have stronger covenant protection versus other investment-grade securities, including both a cap on the gearing ratio at 50% as well as a minimum threshold on their interest cover ratio of 2.0x.

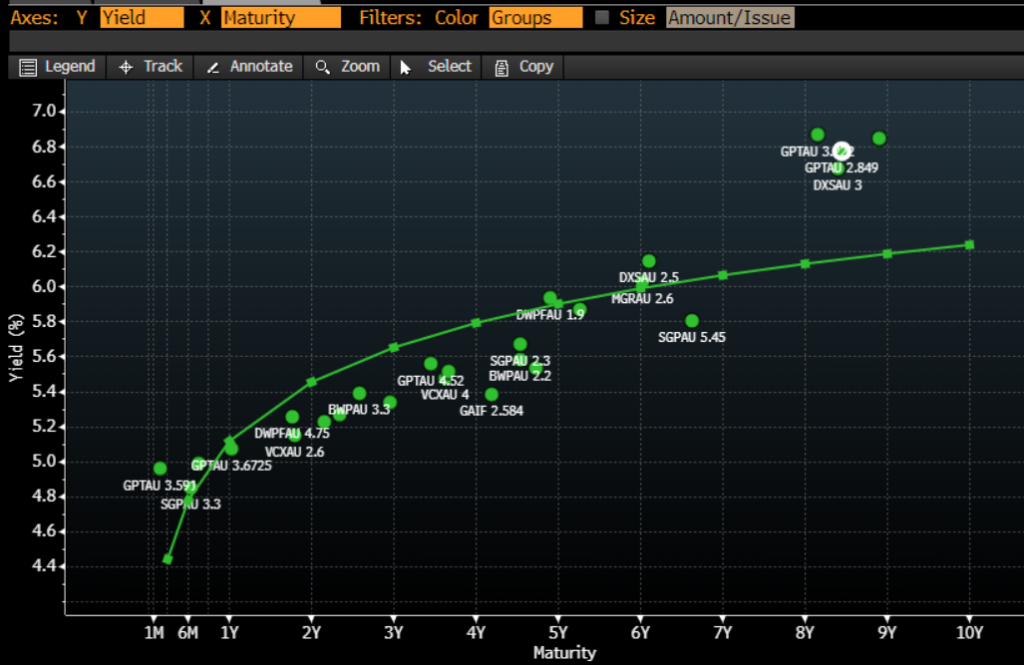

- The large movement in bond yields since mid-2022 means has allowed investors to invest at a significant discount to par. Currently, the clean price was last marked at 75, implying a yield to maturity close to 7%.

These senior unsecured bonds are investment grade rated. In terms of comparable bonds in this sector, GPT’s senior unsecured bond looks attractively priced compared to the AREIT sector. We note the AREIT sector is generally considered low risk by nature of high collateral across retail, office, or logistics assets as well as stronger covenant protection.

Key Risks:

- A reduction in occupancy and leasing outcomes brought on by people shopping less at retail malls (impacting retail assets) or working from home (impacting office assets)

- Asset impairments due to wide-scale property devaluations

- A change in conservative management of its balance sheet

Relative Value (against AREIT sector)

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.