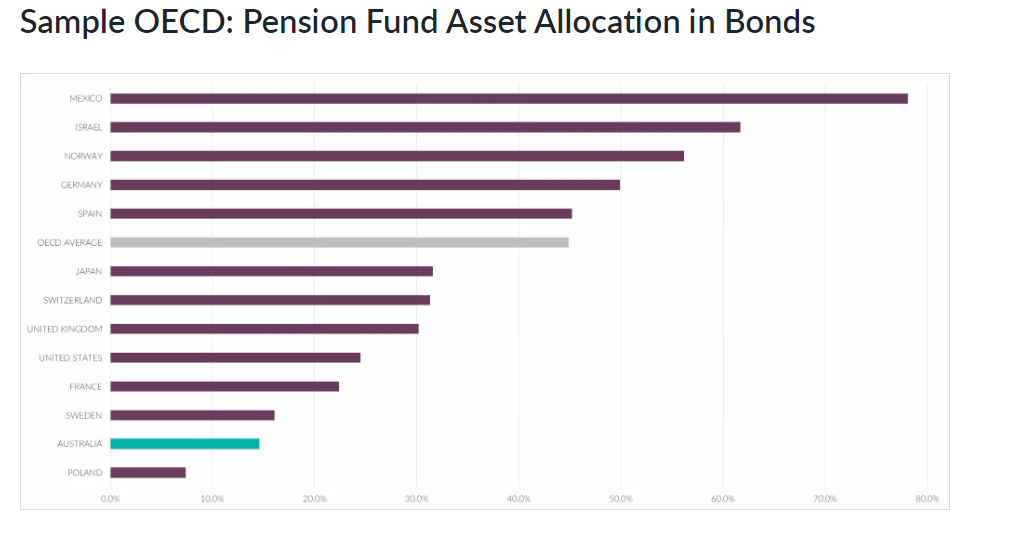

When compared to most other developed nations, Australians tend to have investments that are under-allocated to the bond market. Investment decisions are often confined to those investments perceived to be safer or more known i.e., property and shares. This phenomenon has occurred for three main reasons:

- investors may be more familiar with property and shares;

- investors may be incentivised to allocate into these markets because of the tax incentives (respectively, imputation credits and negative gearing);

- investors may not have a deep enough understanding about the bond market, with a perception that it is more difficult to access, especially for retail investors.

Capital stability versus capital growth assets?

When you are weighing allocations to different asset classes, important differences may sometimes be overlooked. When you allocate to property and shares, you are making a choice to invest your capital in the hope that the price of these assets increases (capital growth).

Property and shares are “perennial” in their nature since there is no date in the future upon which these investments owe you the return of your capital. If your block of flats falls down or you buy shares in a company that goes broke, these assets become finite! But, otherwise they are subject to ordinary market volatility (ups and downs).

The world of fixed income including bonds gives you the option to invest some of your capital in assets which have greater capital stability. A bond has a certain contractual terms which require the payment of interest to you over time and in most cases, a firm maturity date upon which you receive back the full face value of your investment. Therefore, unlike shares and property, bonds are income assets where you can have a high degree of confidence that your capital will be preserved over the life of the investment.

Bond allocations for Australians

Global studies suggest that pension (superannuation) funds allocate almost half of their investment in bonds and fixed income products. In April 2023 the Australian Financial review cited a global study by multinantional Pension Fund Willis Towes Waton which showed that Australian allocations to bond investment were 13% of invested funds, less than half the next lowest of the major countries involved, which was Canada at 25%. The USA is at 29%. Much of that small number is indirectly invested in closed funds or balanced funds, both of which are managed products.

Why should you consider more bonds as you age?

As we get older our earning power decreases, and at some point almost everyone retires, at which time many retirees who are partially or wholly self-funded will need to tailor their lifestyle to enable them to live off their investment portfolios.

The life cycle theory of investing states that individuals should own their age (as a percentage) in fixed income (i.e at 65 years, 65% of your money should be invested in fixed income assets). To restate, as people lose their ability to replace capital over time in potentially volatile share markets, for example, they should increase allocations to fixed income. We consider that this theory should apply at all ages and periods in your investment lifecycle.

Why buy bonds “directly” or through ETBs?

If you’re familiar with equity investing, you may also be comfortable deciding on which companies to invest in when choosing bonds. Bonds provide you with periodic interest over time and capital preservation until maturity through investment in the debt of a company, government or special purpose entity. Direct ownership of bonds can often be difficult due to high financial threshold entry points.

Now you can make investments in ETBs which are listed investments that give you the experience and financial returns (less fees) of bonds without the impediments of direct ownership. ETBs are accessible through stockbrokers, investing apps and ongoing broking platforms.

For any questions on corporate bonds or ETBs, please contact us.