LIBERTY FINANCIAL – LBRFI 16/03/2028

Liberty Financial is a financial services firm with significant Australian businesses in home loans, car loans, commercial mortgages, term investments and equipment finance for businesses in New Zealand as well as secured deposits in New Zealand. It is an ASX-listed non-bank lending firm with a wide range of loans for home, car, business, and personal needs. As a non-bank alternative lender, Liberty’s customers are often outside of the appetite of traditional banks, who may have refused such customers. Notwithstanding this, Liberty has built a strong and consistently profitable business in lending to 600,000 customers by advancing more than $28 billion in funds, over 22 years.

As a non-bank lender, companies like Liberty are reliant upon “wholesale” markets to raise the funds which they use as loan capital. As they therefore do not have a deposit base, their costs of capital are higher. In cases of severe stress these wholesale avenues to capital may seize up and affect Liberty’s business far more than the bank sector.

The senior unsecured bond issued by Liberty has a coupon of 3m BBSW +3.70% and a March 2028 final maturity date. We believe the bond represents attractive risk adjusted returns due to the following reasons:

- Liberty is an investment grade issuer of bonds and mortgage-backed securities and has very prudent capital ratios which exceed those of Australia’s “big four”.

- Whilst their customers are paying higher interest, Liberty’s “Net Interest Margin” (the average of the interest rate it charges minus what rate it pays to access capital) is 2.75%, which is also better than the “big 4” by quite a wide margin. It’s cost/income ratio shows prudent management and Liberty’s return on capital is “bank-like” and far better than most/ all other non-bank participants.

- Since the RBA began tightening the cash rate in mid-2022 the forecast yield on the Liberty bond has been ratcheting up in line with the movement in 3m BBSW. These notes pay variable interest based on a premium to the published 90-day bank bill rate (BBSW). Published BBSW, and therefore the coupons on these notes adjust with changes in the RBA cash rate. These bonds are also generally more stable from a capital value perspective (price/100) than fixed rate bonds as they carry no duration risk.

These senior unsecured bonds are investment grade rated. Liberty’s loan growth has been exceptional and should continue to growth as APRA tightens lending standards for other banks. Liberty is also running an S&P risk-adjusted capital (RAC) ratio above what is required which means there is ample buffer to absorb losses (if they arise). S&P currently has the issuer on positive outlook implying there is a good chance of an upgrade in credit rating in the years to come.

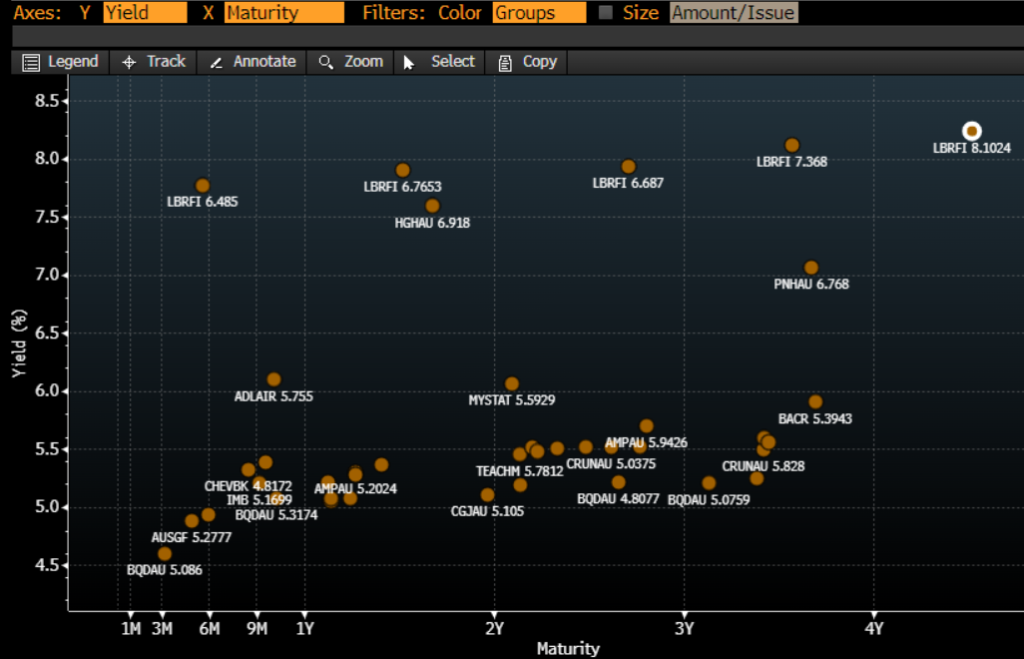

In terms of comparable bonds in this sector, Liberty’s senior unsecured bond trade at a discount to the major and regional banks across Australia. We note the Liberty bonds attract a discount being a non-bank lender given they are not regulated by APRA and so there is an argument that its risk management framework may not be as strong as the major and regional bank peers.

Key Risks:

- Wholesale markets dry up and capital is not able to be obtained in a stressed scenario

- Asset impairments due to wide-scale property devaluations translate into an increased level of non-performing loans and thus earnings impact

- A change in conservative management of its balance sheet

Relative Value (against Banking sector)