You may be familiar with parts of what is termed the ‘fixed income’ market in Australia, either directly or indirectly. In many cases, fixed income investments will be in bank deposits or term deposits. While these have the characteristics of bonds in terms of capital stability, they generally offer lower returns than corporate bonds. To note, deposit products may have the benefit of the government’s deposit capital guarantee.

Below is a table of the current indicative rate of return for different fixed income investments:

| Asset | Indicative Rate |

| Bank Deposits | 3.75% – 4.25%* |

| Term Deposits | 3.75% – 4.25%* |

| Government Bonds | 3.5% – 4.0%* |

| Corporate Bonds | 5.5% – 8.5%* |

*rates indicative at the time of writing

A note on “balanced funds”

Some of you will be familiar with so-called “balanced funds”. These pooled investment vehicles are funds which will have a mixture of bonds and fixed income – and these often have high management/exit fees. While these funds can be expected to have more capital stability than more volatile equity-only investments, you will have to trust a well-paid investment manager to make the decisions. These balanced funds do not have any “maturity date” upon which you can expect to receive all of your capital back and often lack transparency.

What is a corporate bond?

A corporate bond is a debt security issued by a company to raise capital for various purposes. Companies may issue corporate bonds for expansion, to fund new projects, or to pay off existing debts, and to provide regulatory or working capital.

The buyer of a bond is a lender to the company issuing the bond in exchange for a specific rate of interest for a defined period. At the end of the bond’s term (maturity), the issuing company is obligated to repay the bondholder the principal amount of the bond (face value).

Corporate bonds are issued with an interest rate that is usually 1.5% – 4.0% higher than Government Bonds because they have higher risk profiles. Corporate bonds are mostly traded over-the-counter and are not available on stock exchanges unless specifically listed, which can make them inaccessible to many retail investors.

How does a corporate bond work?

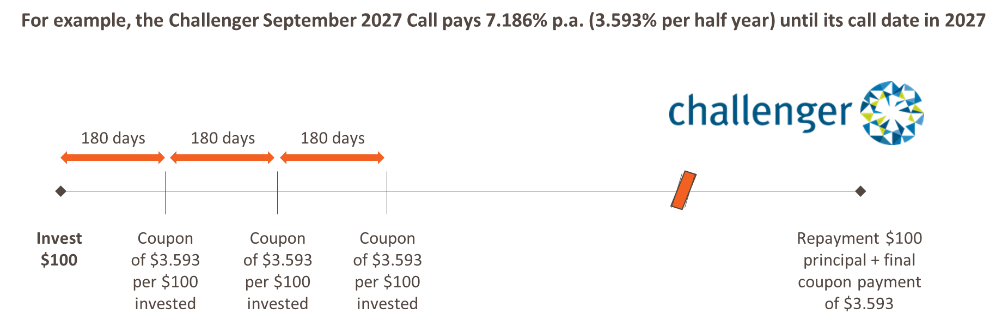

Like any other “loan product” a bond is simply a series of payments to the buyer (investor, lender) from the issuing entity (borrower, issuer, company). Below are the payments that a buyer will receive from an investment in the example bond: Challenger 7.186% fixed coupon bond maturing September 2027:

Types of bonds?

There are several types of corporate bonds that a company can issue, each with its own features and characteristics. Here are some of the most common types of corporate bonds:

- Fixed-Coupon Bonds: These bonds pay a fixed rate of interest for the life of the bond. Coupons are paid semi-annually. Fixed rate or fixed coupon bonds perform best in a stable or falling interest rate environment on the basis that there is an inverse relationship between the bond’s price and its yield, that is, as interest rates fall fixed rate bond rise in value, and vice-versa.

- Floating Rate Notes: Also known as variable-rate bonds, these bonds have an interest rate that is tied to a benchmark rate, such as the Bank Bill Swap Rate (BBSW). The interest rate on these bonds will adjust quarterly based on changes in the benchmark rate and coupons are usually paid quarterly. Floating rate bonds perform best in a stable or rising interest rate environment on the basis that as interest rates rise, the bond’s price doesn’t change but the rate at which the investor coupon or distribution is paid, rises with interest rates.

No matter what your risk tolerance or time horizon to invest, corporate bonds can provide capital stability and strong returns and offer opportunities to diversify your portfolio.