AURIZON FINANCE – AZOAU 3 09/03/2028

Aurizon Finance is the financing arm of, and bond issuing entity for Aurizon Holdings Limited which is a major Australian rail freight operator. Originally a government-owned corporation known as QR National Limited, the business was privatised and rebranded as Aurizon in December 2010. The company operates a substantial network of rail infrastructure, transporting a wide range of goods, including coal, minerals, agricultural products, and general freight.

Aurizon plays a crucial role in supporting Australia’s resource and agricultural sectors by providing efficient rail transportation solutions; each year Aurizon transports than 250 million tonnes of Australian commodities, connecting miners, primary producers, and industry with international and domestic markets. In doing so their businesses provide customers with integrated freight and logistics solutions across an extensive national rail and road network, traversing Australia. Aurizon’s integrated business model provides a defensive stream of earnings from our regulated track infrastructure – the Central Queensland Coal Network, which is made up of approximately 2,670 kilometres of heavy haul rail infrastructure.

During FY 2023, revenue growth was achieved by the acquisition of OneRail Australia (Bulk Central) completed July 2022, and a minor increase to Network Allowable Revenue, offsetting lower Coal volumes, which were nonetheless quite resilient. Significant headwinds however appeared with total operating costs increased by 30%, primarily due to the inclusion of Bulk Central, higher fuel and energy costs (largely pass-through costs) and includes a $15m long-service leave provision adjustment.

The senior unsecured bond issued by Aurizon has a coupon of 3% and a March 2028 final maturity date. We believe the bond represents attractive risk adjusted returns due to the following reasons:

- Aurizon is conservative in its dividend payout ratio, having reduced this by 30% in FY23 over FY22. This is a positive for creditors, including debtholders. There are headwinds in terms of debt maturities in 2024-2026 which will require proactive management.

- Aurizon’s acquisition of OneRail will open Aurizon up to commodities such as copper, grain, magnetite, phosphate, and rare earths and dilute its overall exposure to coal volumes.

- The large movement in bond yields since mid-2022 means has allowed investors to invest at a significant discount to par. Currently, the clean price was last marked at 86, implying a yield to maturity of mid 6%.

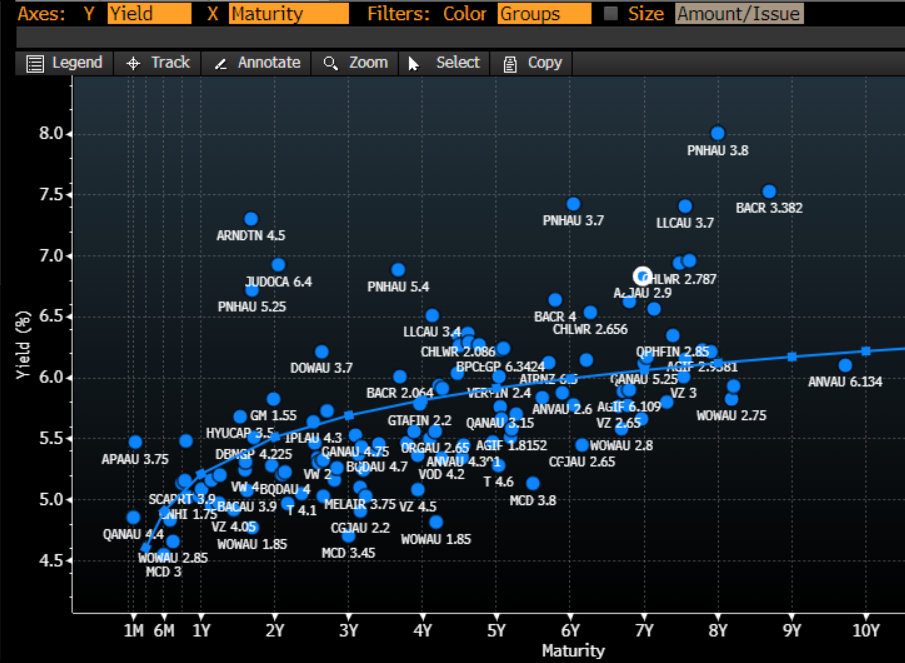

These senior unsecured bonds are investment grade rated. In terms of comparable bonds in this sector, Aurizon’s senior unsecured bond looks attractively priced compared to the rating sector. We note the Aurizon bonds attract an ESG discount given its overall exposure to coal volumes given the above risks factored in.

Key Risks:

- A reduction in coal volumes due to ESG considerations causing refinancing risk

- Inability to deal with higher fuel and energy costs leading to larger-than-expected declines in earnings

- A change in conservative management of its balance sheet

Relative Value (against rating sector)